9 Investing Due Diligence Tips

As a follow up to our blog about the rise of stock trading during COVID, I wanted to share ways new investors can perform due diligence on the stocks they are purchasing. Due diligence is the research that goes into making an important financial decision. Successful investors spend hours doing due diligence before they buy a stock. Without it, you're basically closing your eyes and throwing darts.

When performing due diligence you should look at some of the following things:

- Leadership - Who is running the company and are they capable of executing?

- Customer growth - Are they winning new business at a good rate?

- Customer feedback - What are their customers saying about them

- Operating metrics - how efficient of a business are they? Are they spending a lot on marketing? What are their sales cycles? What are their margins and are they improving?

- Employee happiness - Are they treating their employees well? Can they effectively recruit talented and happy people?

- Technology/product - Do you understand their product well? Are they leveraging technology to make their customers happy?

- Moats - Do they have an advantage that will be difficult for other businesses to replicate?

- Brand - Do they have a well-known brand in their market?

- Business Model - Are they selling widgets once or do they have recurring revenue?

- Investors - Have they attracted successful investors? If they have, you should feel more confident in your bet if they were willing to invest prior to you.

- Fundamentals - Income statements, balance sheets, cash flow statements, and financial reports.

Those are some of my favorite things to research in order to understand a business fully before making a decision to invest or not. How do I research those things? I’ve provided some resources below.

Study their company website

A company’s website is their sales pitch. You can learn about their product, business model, team, and target audience. You can also see all the information relevant to investors on their investor portal. Every public company’s website will have an investor page with presentations, earnings calls, and news. The presentations are always solid resources packed full of the most important data.

Take a look at their profile on Crunchbase

Crunchbase is a database full of information about businesses. People mostly use it to study startups but it is an easy way to find news and past investors in the company’s venture rounds.

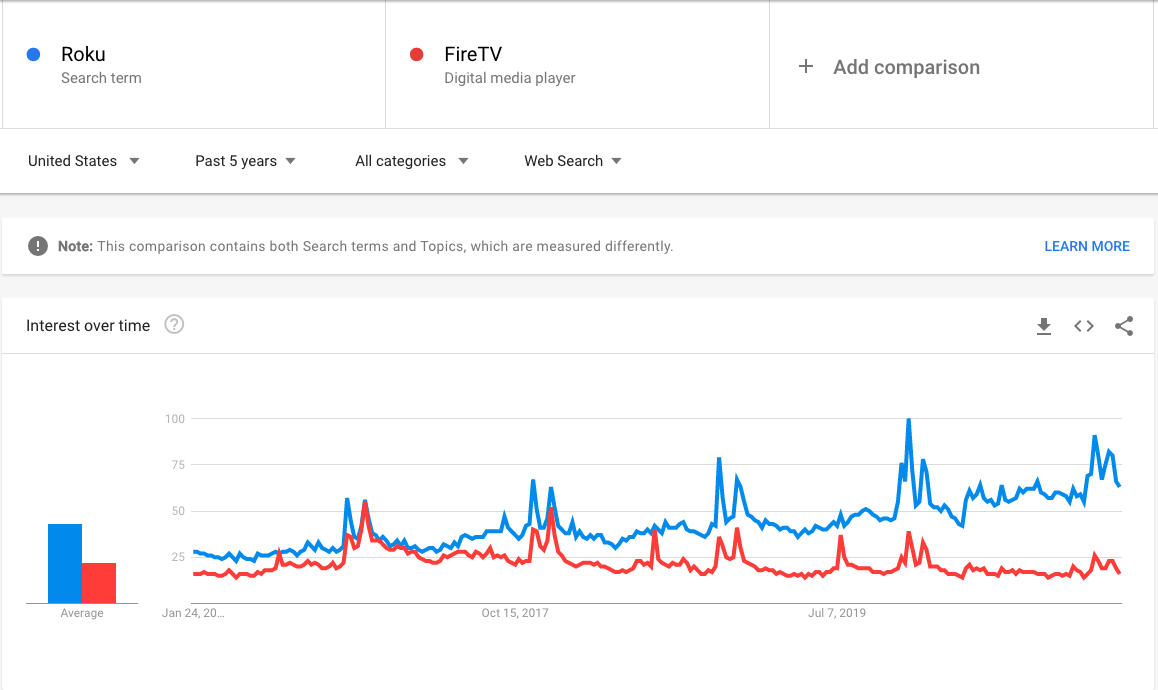

Google Search Trends

I like to use Google Search Trends to understand if interest in the business is increasing on Google. I also like to use it to compare search trends against competitors. In the example below, I compared the search volume over the last five years for Roku to their competitor Amazon FireTV. You can see Roku has a much higher search volume and is trending upward faster. This result is a clear indicator that Roku is the dominant player and that is currently playing out in real life with Roku now having more than 50% of the smart TV market.

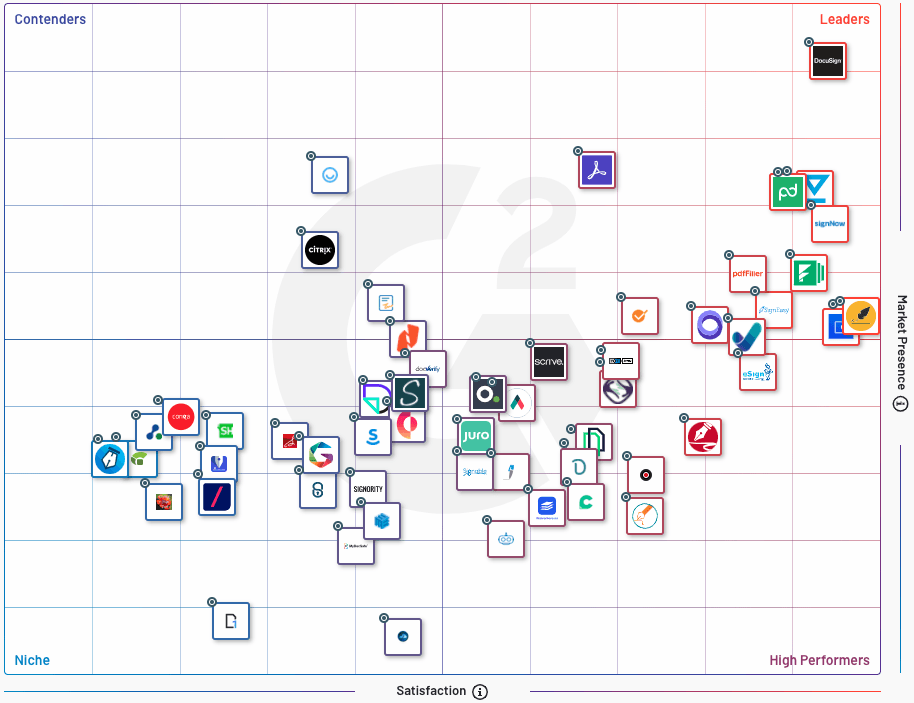

Take a look at their G2 profile

G2 is a site that businesses use to help them make software buying decisions. It provides information like customer reviews, case studies, product tutorials, and product comparisons. I like to read customer reviews and competition grids like the one below. Grids like this help me understand the competitive landscape in their given industry. For instance, I can look at this one and see Docusign is the clear leader in the E-signature market. I can also see who their closest competition is so I can study them too.

Watch their YouTube videos

Before I buy a stock I make sure I understand their product well. The best companies will post very informative videos on their Youtube so their customers can learn about their products.

Check out their Glassdoor profile

Glassdoor is a site that will give you an idea of their workplace culture. It is a job search and company review site that allows employees to rate the business on several factors and leave reviews while those searching for a job can look at job postings and those company reviews.

What are people saying about the company on Twitter?

Twitter, or FinTwit specifically, has become one of the top resources investors have at their disposal. If you have a stock you are following and want to see what other people are saying about it, put a dollar sign in front of the stock ticker. Twitter will return results of what everyone is saying about the stock. I often find great research papers, news, analysis, and investing tips. Follow your favorite investors and engage with their posts.

Twitter is also a great place to find new stocks that are getting people excited. If several of your favorite investors begin to share the same stock, that might be a sign you need to research it. There are some very talented and transparent investors.

Yahoo Finance

There are plenty of places to research a stock's fundamentals. I personally use a combination of Yahoo Finance and Etrade. I like Yahoo finance the most because of the simple but detailed user experience. Robinhood is user friendly but not nearly as comprehensive as others when it comes to data. I use yahoo for reading financial reports and looking at stock charts. I use Etrade to actually buy my stocks and find analyst recommendations.

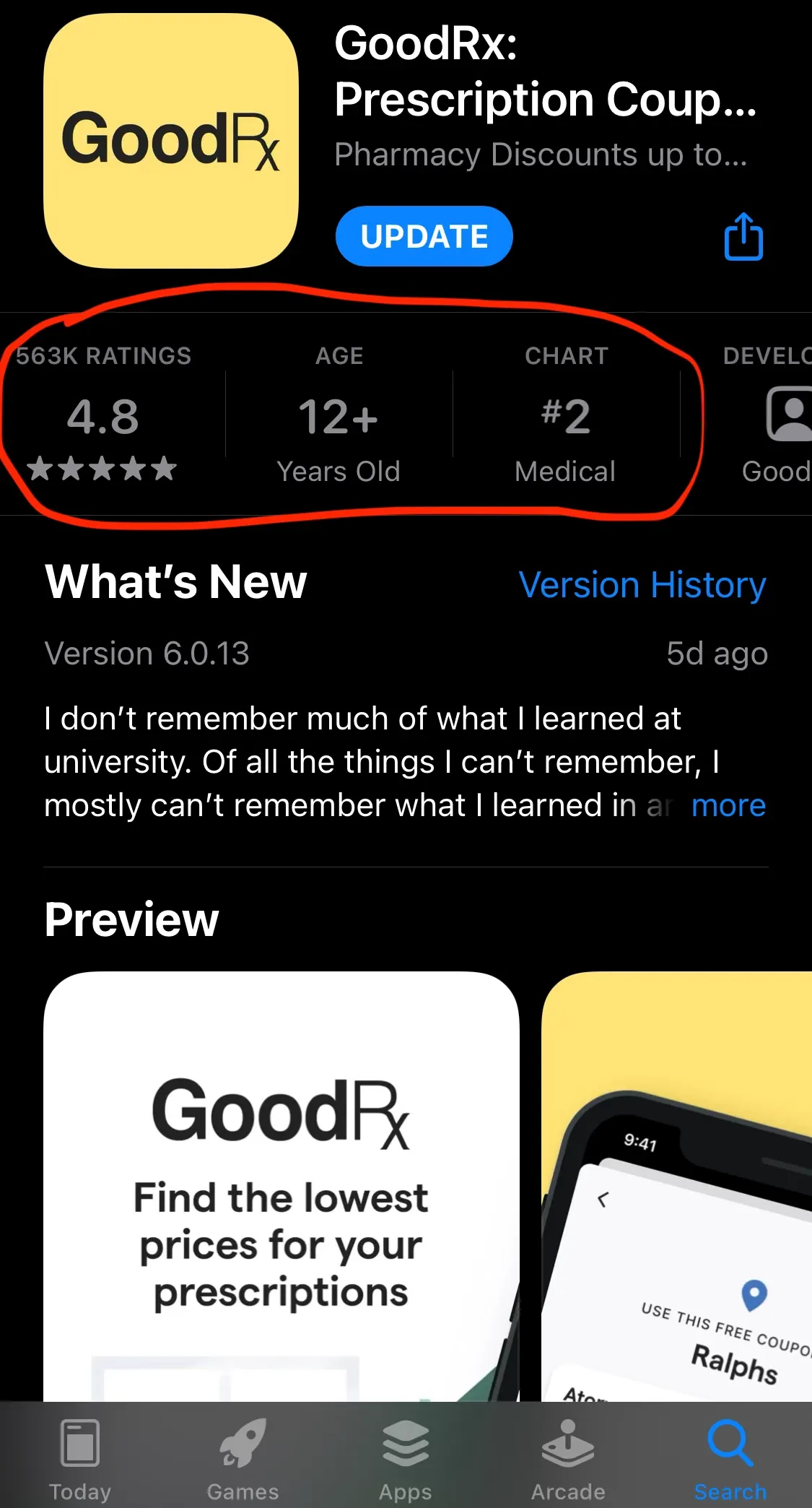

Look in the App Store

If the company you are investing in is B2C, you should check the Apple App Store or the Google Play Store.Go to their app profile to view the reviews, comments, and ranking. For instance, GoodRx is the number #2 medical app in the App Store. That tells be it has mass adoption and momentum to stay at #2 for as long as it has. They are also rated highly on the user experience with 500,000 plus reviews. That is a lot of reviews. That tells me the way their solution to the problem of there being a lack of medical price transparency is well received.

Hopefully, this helps new investors find the right information to make smart decisions. Personally, I spend several hours of due diligence before even considering buying a stock. I've taken a disciplined approach and I suggest the same for readers. Keep a long term mindset and put in the time to research. Having the right data and conviction will allow you to stay focused and avoid emotional decisions. When you get emotional when investing, you lose money. Don't do that.