What is going on with AppHarvest?

What happens when you have zero percent interest rates, ESG, stimulus money, COVID, and SPACs colliding all at once? AppHarvest.

AppHarvest’s SPAC and rocket ship success now appear to be a malicious cash grab by investment bankers and global elites enabled by the highly controversial ESG (Environmental, Social, and Governance) movement. Whether the founding team was aware of what would eventually happen, I cannot be sure; however, I do know there has been poor execution from the leadership team and bad actors like Jeffrey Ubben, who infiltrated the company early to use it as a financial vehicle to quickly cash out millions dollars while the state of Kentucky and everyday retail investors were left holding a falling knife.

Like everyone, I was initially bought in. The state was bought in. The media was bought in. We all bought into AppHarvest.

It's amazing how far saying all the right things will get you. Entrepreneurs and politicians have this gift. They communicate their visions to rally people behind them, and Jonathan Webb is a master of the craft. He masterfully leveraged his experience in DC, free capital, SPACs, the ESG movement, and the narrative of a struggling state (Kentucky) to raise $1.5 Billion dollars in less than 5 years for a dream manifested on a whiteboard years before. Props to him for making his dream a reality… seriously. I want to have empathy for a fellow entrepreneur and don’t want anything to come across as an attack. Give the man props, BUT the problem with dreams is that you have to wake up to face reality. Facts are the facts and reality is setting in…

Middle Tech had Jonathan on the podcast in the early days before any construction started and they had a small team that had just finished raising a $100 million Series A. I left that interview having mixed feelings. I was super excited for the state and for Jonathan’s team, and I walked out of the interview saying “He felt extremely scripted like a politician.” I don’t like politicians very much by nature, but I quickly looked past it because I’m not one to judge based on a first encounter and founders tend to develop scripts when they raise capital. I know I have with my own company.

We kept in touch with Jonathan and his team. They have been great supporters of our work so we followed that interview up with a few more.

Episode 112 with Geof Rochester

After the episode with Geof Rochester, Jonathan, his team, and I spent time drinking bourbon with several other close friends on the side of a mountain in Morehead, KY at Cave Run Lake. We listened to some Tyler Childers and there were good vibes all around.

Next, the grand opening left me awestruck by the size of the facility and the high profile personalities it attracted. Politicians, venture capitalists, construction crews, and many others gathered to celebrate the opening of their flagship facility in Morehead, KY. Jonathan stole the show and delivered an emotional speech during which he paused several times to gather himself. The passion was there and even made me tear up. Being an entrepreneur myself, I love seeing people so passionate chasing their dreams especially when they are this big and in Kentucky. Unfortunately, this was the last time I was bullish about the company. When they SPAC’d, my eyes were opened by several red flags.

We were played:

Let’s start with the FACT that none of this would have happened without the ESG movement. I’m not gonna take a political stance on ESG so do your own research (I give my personal opinions on the podcast) but ESG stands for Environmental, Social and Governance. It is a criteria and a scoring system that holds companies accountable for things like green house emissions, diversity, sustainability, safety, and other socially responsible initiatives. It has influenced how trillions of dollars have been invested around the world. Companies with acceptable scores are placed into funds and rewarded with more liquidity and capital. To date, the ESG movement has proven to be more of a control mechanism and marketing stunt than a profitable and virtuous movement. Mutual funds and bankers are collecting massive fees for moving capital to these companies while the consumers who entrust their money with these wealth managers get less in return than if they had invested their money in a normal index fund.

Jonathan and his cofounders were very familiar with this narrative and movement having worked for the US government raising billions of dollars to fund the US Army’s green initiatives like solar energy. The White House had the goal of supplying 20% of the Department of Defense’s electricity usage from renewable sources by leveraging private sector capital for the projects.

After leaving DC, Jonathan raised $1.5 billion in under 5 years to fund AppHarvest. Raising this kind of money this quickly by a first time founder is unheard of and not possible without 0% interest rates and ESG funds flowing into unproven and risky projects.

There was an excess of money in the system. It was clear because I’ve spoken with the top indoor farming experts in the world and they will tell you, AppHarvest was grossly over-funded and overvalued. Normally, these farming models do not raise venture capital. They use debt to grow. The only hope AppHarvest had to meet its valuation this quickly was if we suddenly ran out of water in North America and we were in a state of emergency. While we seem to be heading that way, who knows when that will happen or if this is the right solution.

Yet, no one seemed to do their due diligence. Well known names and prominent investors like Rise of the Rest, Endeavor, Fidelity, and Blake Griffin saw an inspirational story of a company building farms that use less water while employing workers in safe conditions with high wages and benefits… aka ESG. These early institutional investors who seemed not to care about the feasibility of the idea ended up taking board seats and started dictating who got to invest next and who the leadership team was going to be…

Then, Jonathan and the early team largely lost control of the business. Literally. It was moving too fast and executives like

David Lee were brought in from Impossible Foods (another struggling ESG company) and assumed more control and board seats. Many of these board members had little to no experience in the farming industry and one of them (Martha Stewart) was indicted for insider trading and found guilty of purgery. How did Martha Stewart get a board seat of a B2B company with no consumer brand? I’ll get to that later, but the point is the founders with the original vision have been losing influence.

However, the board member that concerned me the most was Jeffrey Ubben. He is known to be a ruthless activist investor with a legacy riddled with fraudulent companies - as well as some huge successes like Adobe and Microsoft. His job is making money. Plain and simple. And he has left a path of destruction along his way from tech to ESG to consumer prescription drugs to fossil fuels. It doesn’t matter who he hurts along the way. As long as he makes money, it doesn’t matter.

Prior to AppHarvest, he was involved in shady activity at

Halliburton, Valeant, and

Nikola. He has a pattern… Invest millions early, take board seats, exploit a flaw in the market (in this case ESG), speak on the companies’ behalf, pump the stock price up, and liquidate shares. AppHarvest served as a financial vehicle for him to make money at the expense of consumers by exploiting the ESG movement.

In addition to ESG, Jeffrey is known for exploiting consumer drug prices.

While at Valeant, he and his hedge fund ValueAct developed the executive compensation strategy and helped in the overall company strategy that involved acquiring pharmaceutical companies, rapidly raising the drug prices, slashing R&D spend, and laying off hundreds of employees. This pumped the share price up so he could sell his own shares profiting more than a billion dollars.

The US Securities and Exchange Commission eventually investigated the company and shares fell 90%.

Think of Ubben as a pirate. He explores capital markets (ocean) looking for vulnerable companies (other boats) to attack in order to extract value (treasure).

To jump on the ESG boat and diversify his public image away from ValueAct and Valeant, he started a new fund called

Inclusive Capital to virtue signal and make green investments so he can bond better with his wife who is a nature conservationist. He is on record saying that in

this interview. What a sweet husband! These funds were where his investments in Nikola and AppHarvest came from.

Mix the ESG movement with SPACs and you have unregulated, weaponized finance… What is a

SPAC? It stands for Special Purpose Acquisition Company which is a company without commercial operations that is formed strictly to raise capital through an

initial public offering (IPO.) Traditionally, pre-IPO companies have to work with large investment banks - for example Morgan Stanley - to go public. The bank does an extreme amount of due diligence to underwrite the deal. The company goes on a road show pitching hedge funds and other large investors who then set a price for the company to go public. Then retail investors can get in on the action after the smartest investors in the world get a first look. However with a SPAC, there is little to no due diligence. They merge with a

blank check company and offer shares immediately to the public. It’s proven to be a way to bailout

zombie or overvalued companies.

Why is this relevant? Well, AppHarvest raised about $700 million prior to IPO and inflated the valuation to something that made zero sense. THEN they SPAC’d knowing retail investors would buy into the hype and the ESG funds would gobble up the stock on the backend. Which they did…

These ESG funds are made up of consumer funds by the way. They are pension funds and other vehicles consumers use to invest for retirement. Some states are beginning to ban ESG investment within their pension funds. Further proof of this problem is the top four/five institutional investors in

Nikola and

AppHarvest are identical, and of course, they are some of the biggest supporters of ESG in the world.

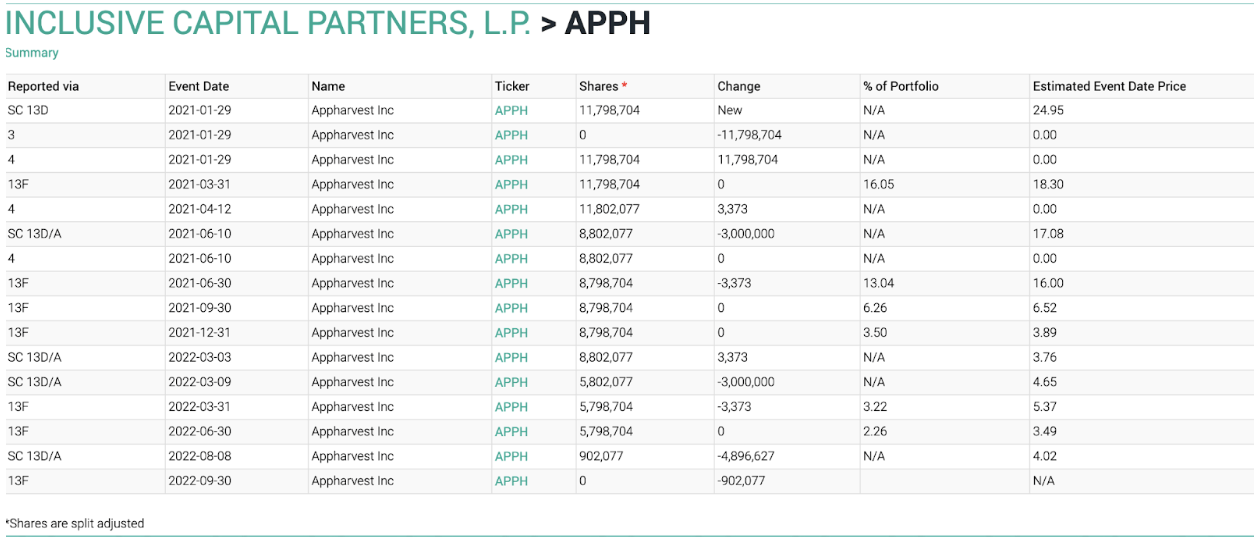

So Jeffrey Ubben and other investors exploited ESG to pump the stock and have since cashed out thanks to the SPAC. Ubben is no longer a share holder. Below is an audit trail of all his trades of the AppHarvest stock after the SPAC as well. This does not include his shares he got when they went public. He was still trading the stock and because of this behavior, Ubben is currently being accused of a "short swing" in a lawsuit detailed

here.

The exact same thing happened with Nikola and that was actually a fraudulent company. The founder Trevor Milton is gonna be in prison and Jeffrey is just chilling doing the same thing to AppHarvest.

On a final note related to Ubben, he was the second largest shareholder and member of Martha Stewart's board when she was indicted on insider trading so he made sure to welcome his old pal into AppHarvest.

This is how the financial markets and investors affected the company. How about their execution and its effect on the business?

If you know how to read a balance sheet or an income statement, it was pretty obvious from the get go that AppHarvest was going to run out of money or continue to dilute investors by raising more capital. They did exactly that while

trying to cut costs. I say

trying because you can look all over the city of Lexington, KY and see AppHarvest has been spending money on things that made zero sense - like a food truck that was turned into an indoor farm and two retail locations that never had staff working or people visiting. The biggest head scratcher was

AppHarvest’s acquisition of Root.ai which was a robotics company they acquired for $60 million only to lay off the team several months later because they couldn’t support their expensive salaries.

AppHarvest later wrote the entire acquisition off as a loss in the form of goodwill. Evaporated.

One of the disappointing ways AppHarvest began exploring cost savings involved seeking migrant workers to work in their farms. Initially, AppHarvest touted their mission of hiring local workers, paying them great wages, and providing benefits. But as time has progressed, productivity waned, and the stock price has fallen, it seems that management sought to hire

migrant labor leveraging the

H2A program. As they sought these migrant workers, they laid off the majority of their team that occupied massive amounts of commercial office space in downtown Lexington. As part of the layoffs, NDAs were signed by employees so the public didn’t get word of things going south.

One final but absolutely crucial piece to this puzzle is AppHarvest’s relationship with Mastronardi. AppHarvest’s only customer is Mastronardi and they control AppHarvest’s prices, distribution, and expansion plans. So AppHarvest never actually controlled their own destiny, and it appears Mastronardi will literally own AppHarvest. I say that because

Mastronardi and AppHarvest formed a joint venture and Mastronardi just acquired AppHarvest’s real estate in Berea with plans to lease it back to AppHarvest. I expect this will happen with the rest of their facilities.

Where are we today? Well, the stock is priced below a dollar down from highs of around $40 and just about all of the early investors have sold their shares leaving Jonathan the largest shareholder. Jonathan currently owns almost 20% of the business but the value of the business has fallen 97% since its highs.

As a result of this market failure and poor execution, the company recently announced they are running out of money and restructuring. However, in all this turmoil, executives David Lee and Julie Nelson are

getting severance packages that amount to $7 million which is about 50% of AppHarvest’s 2022 total revenue. You read that correctly. People are still extracting value from the company.

How would I summarize what we witnessed with AppHarvest?

Higher powers that sit in fancy rooms came up with a vision for the world, they created narratives that aligned with that vision, they systematized it in the form of ESG, they told the world how to move money, savage capitalists and ESG funds moved OUR money without our knowledge in exchange for fees, pirates like Jeffrey Ubben took advantage, and they have made out with billions and billions of dollars. Sadly, AppHarvest was a small piece of that bigger game in which the people of Kentucky and the retail investors are the losers. This is an unfortunate market failure.

Meanwhile, Ubben

just joined the board of ExxonMobil which is one of the largest fossil fuel and emissions producers in the world.

And by the way,

ExxonMobil’s ESG score is worse than fraudulent FTX and

better than Tesla which is the number one electric vehicle company in the world.

Ask yourself … “Would any of this have been possible without the ESG movement and SPACs?”

The answer is NO.

Just like engineering teams build rockets that go to the moon, financial engineers create elaborate schemes to make billions and control people. Sometimes its good capitalism, sometimes it's malicious capitalism, and sometimes it's fraud.

Time will tell what AppHarvest’s legacy will be.