Bourbon, Basketball, and Business: The Growing Technology Startup Scene in Lexington, KY

This article was originally written by Nate Antetomaso in November of 2017 and helped spur the creation of Middle Tech. It is reproduced here in its entirety.

Lexington, KY is synonymous with thoroughbred horse racing, top quality bourbon, and world class college basketball. In a town that many equate with old money and established traditions, one thing that runs completely counter to that is a budding industry beginning to emerge in the city: tech.

A couple of weeks ago I was lucky to be able to participate in a panel during Kentucky Innovation Network’s programming for Global Entrepreneurship Week. One question that was asked went along the lines of “what did your friends and family think when you told them you were accepting a job at a startup?” Luckily, my family is extremely supportive and my friends give me crap about everything (not just this) so I had no reason to second guess my decision. It’s a valid question, but the fact that we had to be asked it in the first place stuck with me. I live and operate for hours each day in the tech world and (for better or for worse) it’s become the norm to me. Just like with anything, tech culture is hard to fully get from the outside looking in. But when thinking more about it I realized that many aren’t even looking in. Technology is here in Lexington and is already having a very real impact on the city, but many aren’t even aware.

The Ingredients for Growth

Tech companies are popping up all over the city following the startup trend that began in the Bay Area years ago, slowly took over both coasts, and is now settling into the Midwest. There are big players, little players, and supporters all over the industry, and Lexington is no different. The Bluegrass serves as a microcosm for the tech industry as a whole, and parallels can be drawn between our budding local scene and the overall national scene.

Silicon Valley emerged in the Bay Area decades ago for a myriad of factors including entrepreneurial support from Stanford who saw itself as an advocate for the region and also just so happened to have extremely strong STEM graduates. Silicon transistor and semiconductor production began to take over the area which brought venture capital along with it. As technology has improved and popular focuses have shifted from hardware to networking, then to the internet, and now to software, Silicon Valley has remained to center of it all.

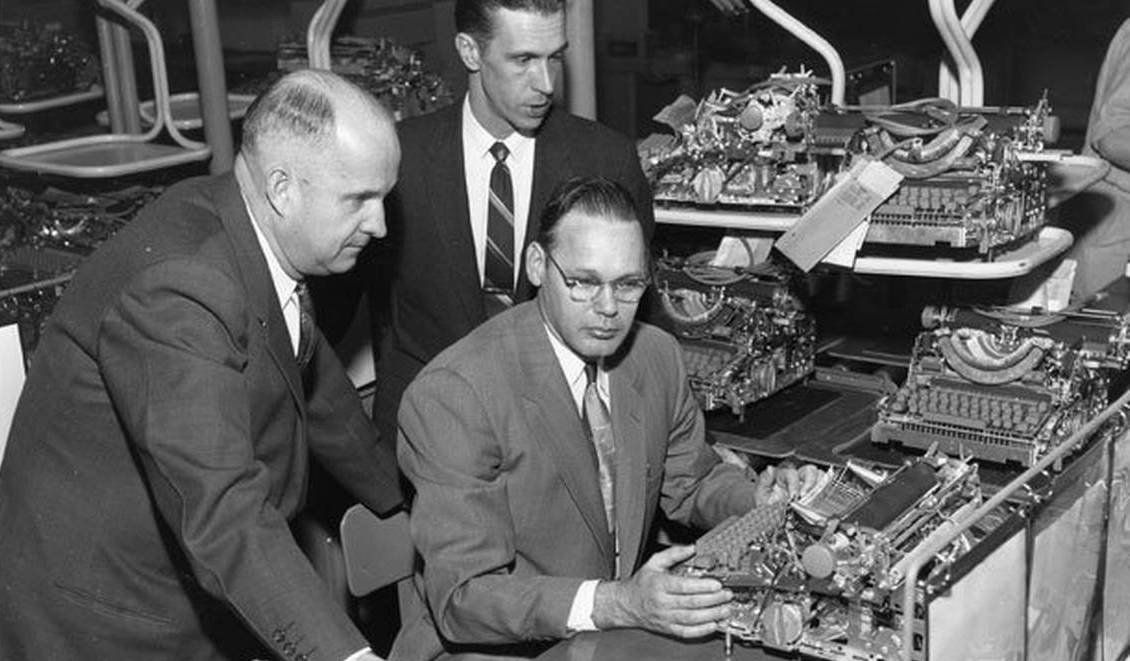

Lexington has a less storied history in tech but still has its own roots from the past. In 1956, IBM came to Lexington to build a 386,000-square foot typewriter plant off New Circle Road and employed 1,800 people. The company did wonders for the growth of the city as the operation employed more and more people and slowly evolved into a focus on laser printing. In 1990, a private equity firm scooped up the division and Lexmark, a company that still employees 2,000 people locally, was born.

With both regions’ historical factors playing a part in today’s tech scenes, the most obvious modern similarity between the two is Stanford and UK. In addition to being the top employer in the Bluegrass, the University of Kentucky pumps out thousands of graduates each year across 200+ majors including those from the College of Engineering which ranks in the Top 100 nationally according to U.S. News & World Report. UK is the defining institution in the region, so it’s no surprise that it has an impact on the burgeoning industries surrounding it.

Furthermore, in the same way that venture capital exploded the entrepreneurial possibilities in the Valley, it is now beginning to do the same in the Midwest.

The idea is “that the middle of America amounts to an undervalued asset, rich in markets, new business ideas and budding entrepreneurs. The Midwest, the thinking goes, is not only untapped, but also an antidote to the scalding-hot tech market on the West Coast.” -NYT

More and more venture capitalists are investing in the Midwest and when seeds are planted things start to grow. The top 50 VC firms in midwest states represent over 42,000 investments with Chicago being the obvious regional leader but smaller urban hubs like Cleveland, Indianapolis, Cincinnati and more pulling their own weight. The money is spreading inland for multiple reasons including cheaper labor and operational costs as well as the midwest’s expertise in manufacturing, agriculture, and healthcare: three industries just beginning to be disrupted by tech.

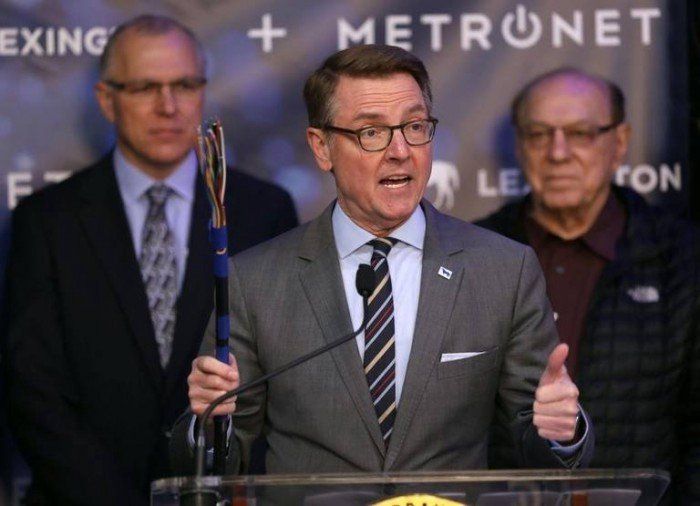

But Lexington also has something unique that is invaluable to the startup community: government support. In 2013, the Lexington-Fayette Urban County Government started the Jobs Fund under Mayor Jim Gray, a $1 million allocation to provide grants and loans to local businesses (especially those headquartered in Lexington) with a priority to fund advanced manufacturing and technology endeavors. Business that apply to the Jobs Fund must prove viability and meet certain criteria, but with such relatively easy capital available it’s clear to see how opportunities begin to grow. Mayor Gray’s support of startups and technology goes beyond the financial sector as he just announced a strategic partnership with MetroNet to lay up to $100 million fiber optic cables across the entirety of Lexington’s urban service area, making it the nation’s largest “Gigabit City.” With fast data speeds, available money, and a low cost of living, Lexington’s tech sector is sure to keep growing. But where is it right now?

The State of the Sector

Lexington tech is obviously small in comparison to bigger cities and still has a long ways to grow, but the very real impact it’s producing on the city is nowhere near negligible. Companies like Fooji (a B2B company that provides brands with a scalable experiential marketing platform), MakeTime (a marketplace to utilize and sell unused machining time), Big Ass Solutions (an advanced fan and lighting manufacturer that just sold for half a billion dollars) and more are employing hundreds of skilled professionals. Besides these, not many other startups have large numbers of employees, but there are dozens that employ 10+ skilled professionals which add up to a large technical workforce that is able to live, spend, and flourish within the local economy.

The tech industry goes beyond established startups, of course, and arguably just as influential as those companies are the support organizations that breed interest in the industry as a whole.

Awesome Inc. is an incubator/coworking space/code-school that helps grow local talent and accelerate the opportunities available to that talent.

Base 110 is a new coworking space complete with conference rooms, a recording studio, and more amenities necessary in a modern office. Other, less physical organizations also exist to spur creation and growth like the

Kentucky Innovation Network (an economic development agency focused on business creation), and UK’s own Von Allmen Center for Entrepreneurship. These organizations all focus on creating opportunities for potential and current entrepreneurs alike and their services range to cover all types of resources and aide needed when starting up.

With all of this in place it’s clear that Lexington is becoming a warm home for tech within the larger landscape of the Midwest. The potential for innovation and growth is no longer just for those on the coasts. It’ll be exciting to see what is in store for our city as we continue to promote entrepreneurship, technology, and skilled labor which will in turn grow the local economy and redefine what the Bluegrass is all about.