AppHarvest Goes Public

What a morning in the Kentucky business ecosystem! It was announced around 8:30 this morning that AppHarvest, the sustainable agriculture startup founded in Eastern Kentucky, will be going public via a Special Purpose Acquisition Company (SPAC). This news is very exciting for AppHarvest and the state of Kentucky. Middle Tech has had three interviews now with the AppHarvest team and we have been truly amazed by the project, their ambition, and the execution thus far. To give people an idea of what is happening here, Jonathan Webb and his team are working hard to make Appalachia the AgTech Capital of the World. This might sound like a lofty mission, but AppHarvest would argue it’s an urgent and necessary goal given the world’s projected food shortage and worsening climate. Let’s dive in…

On CNBC this morning, the CEO and Founder of AppHarvest was joined by new board member, Martha Stewart, to announce that AppHarvest would be taken public via SPAC (pronounced “Spack”). This is a relatively new financial innovation that allows a company to go public while bypassing the traditionally lengthy and expensive IPO process. SPACs have garnered a significant amount of both positive and negative press lately as the number of these entities has exploded to 112 in 2020 - more than 5 times the 2015 total of 20 and almost twice the 2019 total of 56. This increase occurred at the same time as the market for IPOs greatly expanded on the back of equity markets surging to all-time highs. A number of prominent names, including Nikola Motors, DraftKings, and Richard Branson’s Virgin Galactic, have also gone public using SPACs.

A SPAC is essentially a shell company that issues common shares through a public offering for cash that will be used to find a private company to take public within what is typically a 2-year period. They are typically raised and managed by well-known investors who have large followings that can be leveraged to quickly raise the large dollar amounts needed to make these acquisitions - Chamath Palihapitiya and Bill Ackman being prime examples - and earn a fee known as a “promote” for their efforts upon a successful acquisition. During this search phase, SPAC entities have no operations other than searching for a willing target company. When a deal is struck, the SPAC acquires or merges with the company that intends to go public and uses the proceeds of the initial public offering to recapitalize said company. Once the deal is closed, the SPAC entity ceases to functionally exist, but the investor typically stays involved as a strategic advisor or board member. This process will provide value in several ways to AppHarvest’s stakeholders:

- It allows Appharvest to acquire capital quickly and use that to grow the business.

- The traditional IPO process is often lengthy, expensive, and is rife with principal-agent conflicts. Using a SPAC to go public allows AppHarvest to bypass this.

- Because SPACs are popular in the media, it can provide a boost in AppHarvest’s publicity.

- Being a public company provides AppHarvest stakeholders with greater transparency and provides a different sense of accountability.

- The general public can now share in the success of the business as they have access to equity ownership through public markets.

Why is AppHarvest doing this now? Well previously, they had raised about $150 million dollars from venture capital firms. Well-known firms like Steve Case’s Middle America focused Rise of the Rest and sustainability-focused Equilibrium Capital got involved early to help fund the construction of the massive greenhouse. That capital was enough to get AppHarvest’s 2.76 million square foot indoor farm up and running with an expected grand opening in October. If you want to see the progress leading up to their October ribbon cutting, we encourage you to go to the AppHarvest Instagram to follow the facilities progress. This time around, the capital raise was not about the facilities. They have executed on that part of the equation thanks to Jonathan’s previous experience building some of the world’s largest solar projects. This time around it is about executing on their mission to make Indoor farming the norm in not only Kentucky but the United States and the world. Appharvest argues we need swing for the fences bets like this in order to survive on this planet. So this is fuel to save the planet given experts believe we need the equivalent of two planet earths to provide enough food for 9 billion people.

Why do we need two planets to feed the world? Simply put, we are not growing enough food and that’s because of current agricultural practices, climate change, and lack of innovation. Most of America's food is grown in the Southwest United States and Mexico. That region of the world is facing severe and worsening water shortages and the farming methods they utilize frequently involve chemicals. The world population is expected to rise to 9 Billion people within the next 25-30 years and we will need 60% more food to feed everyone so current practices won’t cut it. We need something new and that is where AppHarvest comes in.

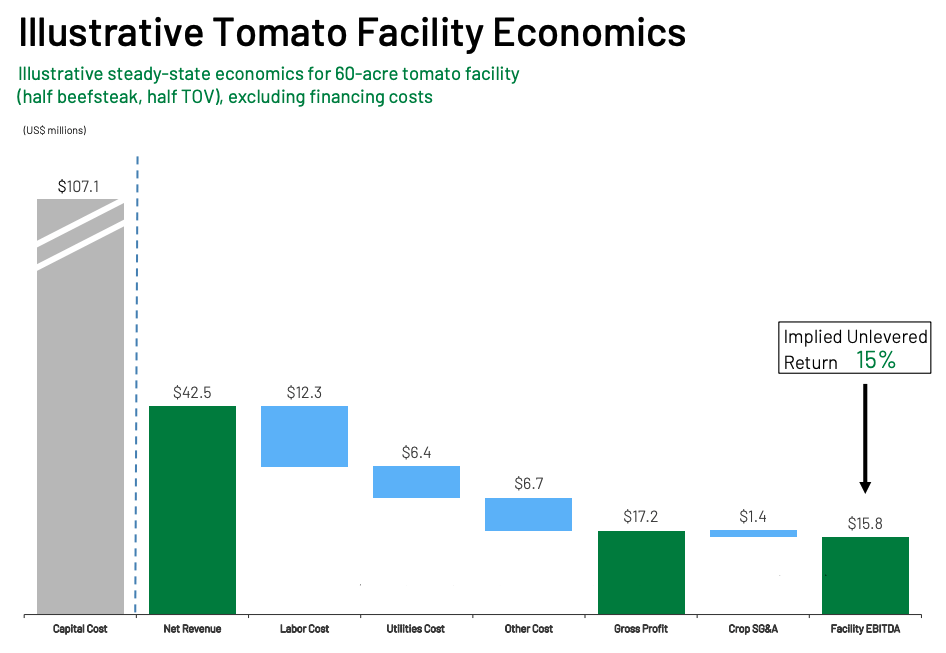

If you want a glimpse into the future AppHarvest is creating, take a look at the work being done in the Netherlands around sustainable agriculture. The Netherlands is the second biggest agricultural exporter behind the US but produces these exports with only a tiny fraction of the amount of land in the USA. That is a result of their innovative growing practices, and by the way, AppHarvest has partnered with Netherland based companies to pull this Kentucky project off. When complete, the AppHarvest facility will be one of the largest buildings in the world at 60 acres of controlled indoor farming and it will produce 45 million pounds of produce using 90% less water. The 45 million pound yield is about 30 times more per acre than traditional open-field agriculture! The location of this project is also important given 70% of the US population is within a day’s drive of Eastern Kentucky meaning AppHarvest will cut transportation costs down by about 80%. This facility will employ more than 300 people in a region that is starving for jobs. This is a once in a lifetime opportunity for the state of Kentucky that hopes to move from coal production to now sustainable food production. What a story!

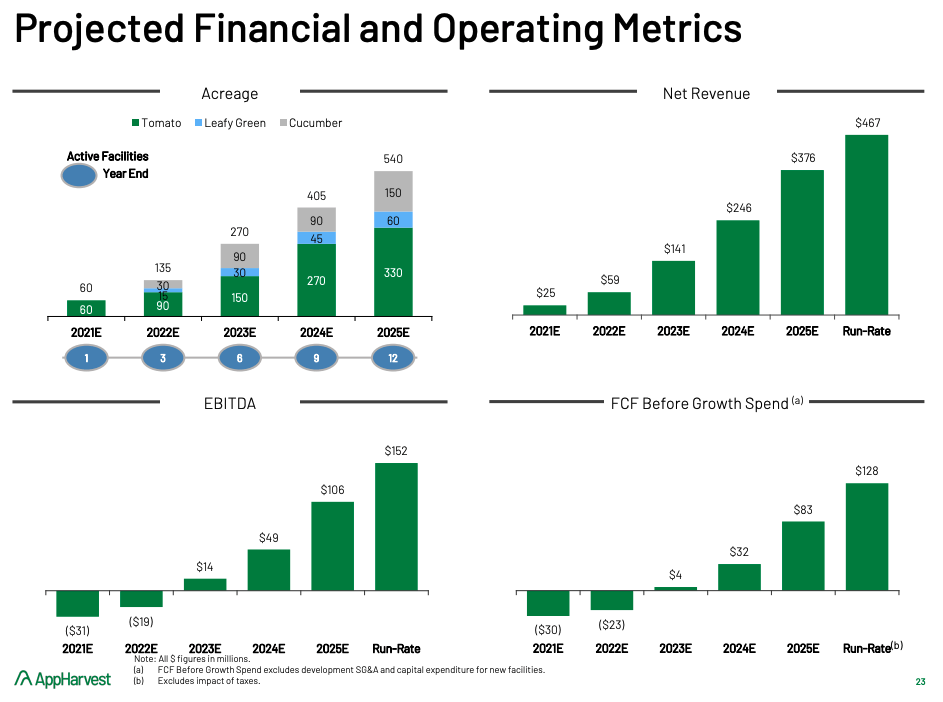

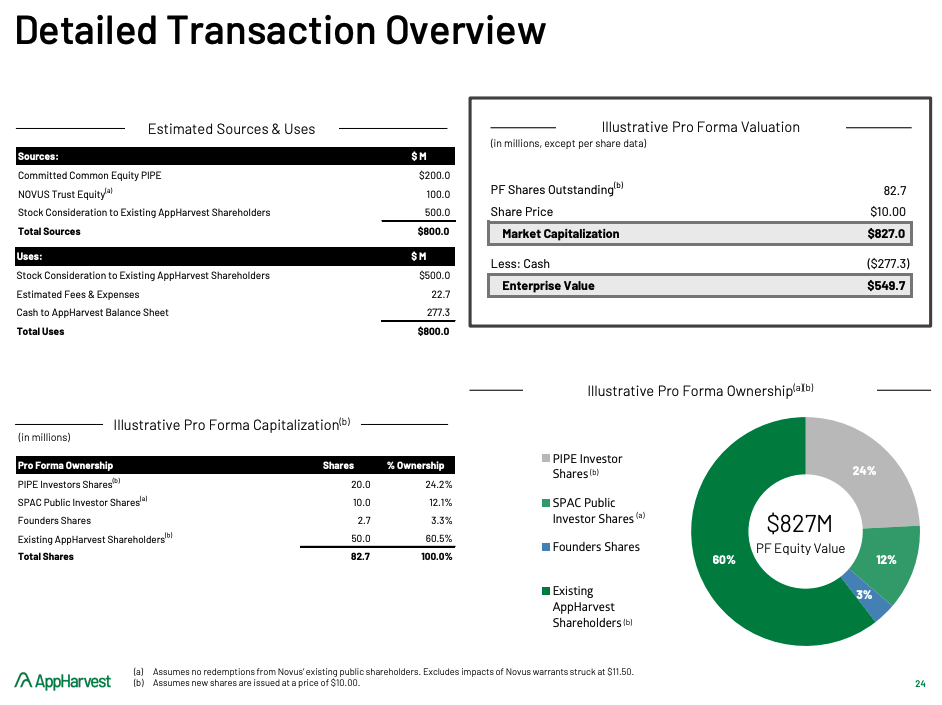

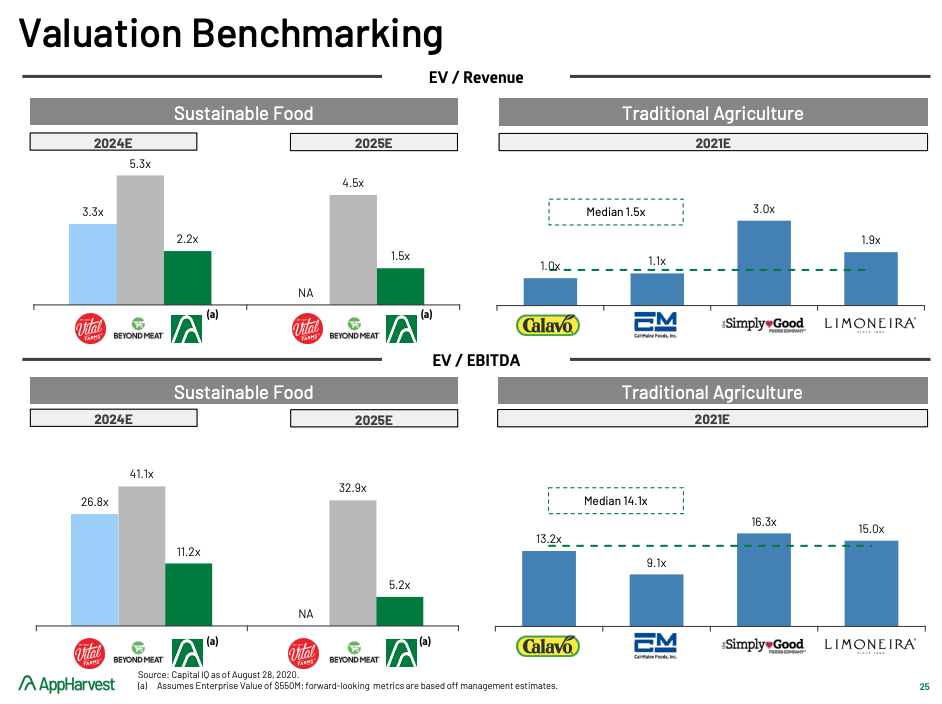

AppHarvest is truly changing the future of Kentucky and it doesn’t stop with the project outlined above… If all goes as planned, the company plans to build 8 more similar facilities in Kentucky cities like Berea, Richmond, Russell Springs, and others. That would without question put Kentucky on the world’s stage and play a major role in feeding the world far into the future. The plan to accomplish this will require strong financial growth and execution. We’ve shared slides from their investor deck below to give you an idea of the financial projections and their valuation.

We will continue to cover the Appharvest story as it develops. To date, we have done three interviews with the AppHarvest team including CEO Jonathan Webb, their Director of Community Outreach and People Programs Amy Samples, as well as their new CMO Geof Rochester. Those are great interviews and we encourage you to take a listen! Congrats to all our friends involved and we look forward to tracking the progress!